One of the questions we get asked most often at Liquid Stock is, “why does it matter when I exercise my private company options?” Our response is that it can matter a lot, for a variety of reasons, from the amount of taxes you’ll pay to the risk you’ll bear.

Option exercises at a private company often fall into one of three scenarios: exercise early, exercise when there is clear visibility to an exit event, or wait until a company is public to exercise. Each scenario has benefits and risks associated with it, and your decision will likely depend on your unique situation – balancing both economic factors, as well as your willingness to bet on your company’s future performance. Please keep in mind that each of these scenarios assumes that your company shares appreciate in value between the time of your options award and the exit event, whether this actually happens is a significant risk to consider before exercising any of your options.

For clarity, this article is specifically focused on non-qualified stock options (NSOs). If you hold incentive stock options (ISOs), the financial difference between an early exercise and doing nothing until an exit can potentially be even greater.

So, what could each of these option exercise scenarios look like financially? Here we will outline these three common scenarios and include some high-level numbers to help illustrate each one. In each scenario, we will use the example of a California resident – let’s call her Sara – with a federal income tax rate of 37%, holding 500,000 NSOs with a strike price of $0.10 per share, an exit value of $10.00 per share and shares sold for $10.00 each.

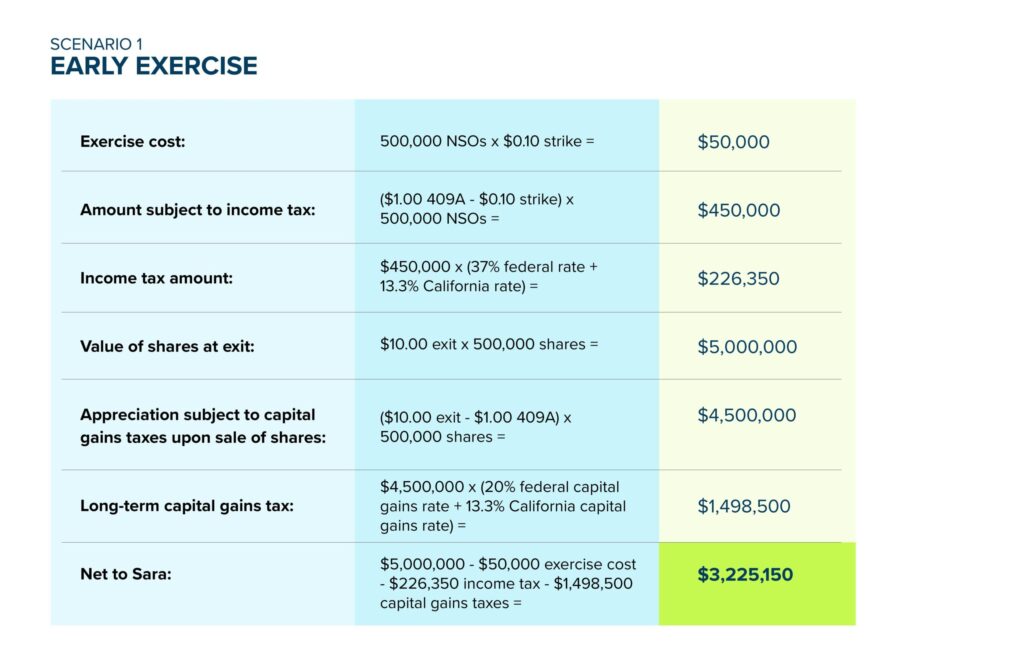

Scenario 1: Early Exercise

One path for Sara is to exercise her options shortly after being granted, if her grant allows for an early exercise – meaning the right to exercise before the options have vested. Sara may aim to early exercise before there is a significant increase in 409A value (aka fair market value or FMV). This potentially allows for the most tax efficiency, as the taxes on options are calculated based on the difference between her strike price and the 409A value at the time of her exercise. Upon the sale of shares that have been held for over one year, Sara will be taxed on the difference between the 409A value and the sale price using capital gains rates, which are typically lower than ordinary income rates. With that in mind, what could this exercise scenario look like for Sara? Let’s assume that the 409A value of the shares is $1.00 at the time that Sara exercises. We’ll run the numbers for you:

Scenario 2: Later Exercise

Now, let’s consider Sara’s situation if she decided to wait until she had greater visibility on the likelihood of a potential exit event. We will still assume that her shares are held for over one year postexercise, but the 409A will have increased to $7.00 per share prior to her exercise.

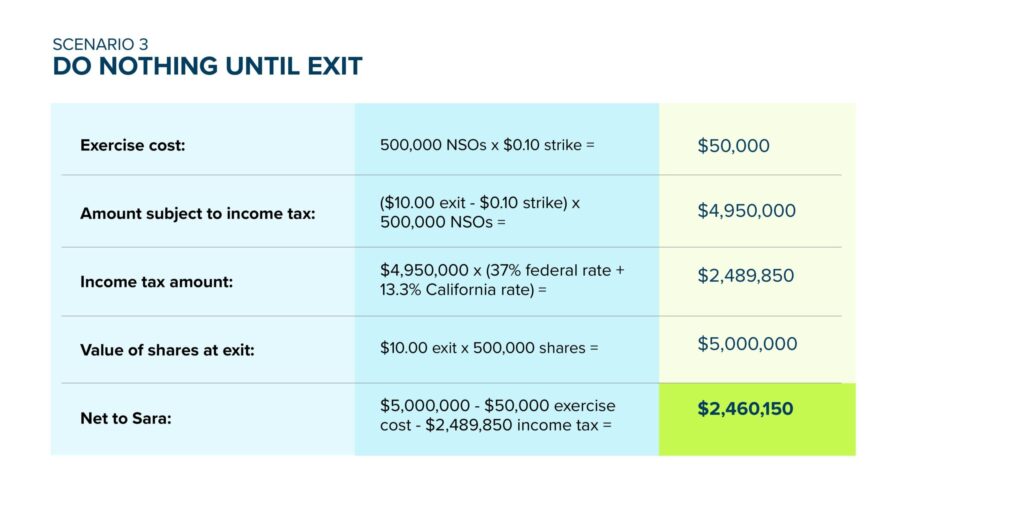

Scenario 3: Do Nothing Until Exit

Lastly, let’s walk through the numbers if Sara decides to wait until her company is public and her company allows her to do a cashless exercise to cover her taxes. In this scenario, she would not hold the shares for over one year, and the 409A would not be a factor as a public company.

The Upshot

We will be the first to admit that all three of the above scenarios are good outcomes for Sara, but how might she think about them in terms of tax efficiency? On a percentage basis, the numbers start to become material. In the three scenarios above, early exercise results in potentially 18.8% ($510,000) more money in her pocket vs. a later exercise. Early exercise vs. waiting until her company exits results in 31.1% ($765,000) more money. For a large options position, or a company that has experienced a tremendous increase in valuation, this can be substantial wealth that Sara is passing up due to the timing of her options exercise.

Risks to Consider

Clearly each scenario has its own sets of risks and rewards and as noted earlier, your tolerance for risk will likely dictate which scenario you choose to execute. The downside to early exercising is that you may not have a clear picture at the time of whether your company will be successful. If the company is ultimately unsuccessful, you could lose money spent to exercise your shares. That money could have been spent on other opportunities. This can also make it difficult to find funding if you are unable to pay to exercise the options yourself. Unfortunately, the IRS is generally unforgiving if you exercise options, generate a large tax bill and your company fails or does not perform well. Waiting until later helps alleviate the risk of not knowing whether your company will be successful, but it increases the risk that you will not be able to afford to exercise your options due to the tax burden. In our early and later exercise scenarios above, Sara’s cost to exercise increases over 6x by waiting ($276,350 vs. $1,785,350). Waiting until your company goes public may be the lowest risk scenario because you are selling publicly traded shares to cover the taxes and not using your own money, but it may also provide the smallest amount of after-tax dollars.

At Liquid Stock, we understand that not everyone is in a position to exercise their options prior to an exit event, but our option-exercise solutions may be able to help. We can work with you and your advisors to look at the option-exercise scenarios you’re facing, and structure an option-exercise solution.

This blog post is intended for general informational and education purposes only. Liquid Capital Management, LLC (together with its affiliates, “Liquid Stock”) makes no representations as to the accuracy of information in this post, and no representations or guarantees as to specific outcomes from relying on this post. No content in this post is intended or should be construed as tax, investment, legal or accounting advice by Liquid Stock, or as an offer to sell or solicitation of interest to purchase any securities offered by Liquid Stock. Liquid Stock does not provide tax or other financial, legal or regulatory advice to its transaction counterparties. Always consult with your investment, tax, and legal advisors before making important financial decisions. The terms of any Liquid Stock transaction may vary. Outcomes (including financial and tax outcomes) of any transaction will depend on factors including the timing and value of any liquidity event. While reasonable steps have been taken to ensure that the information herein is accurate and up to date, no liability can be accepted for any errors or omissions. All views and information contained herein are as of the date hereof and subject to change. Information contained in third-party links has not been independently verified by Liquid Stock and inclusion of such links should not be interpreted as an endorsement or confirmation of the content therein. Prospective investors considering an investment in a Liquid Stock fund should not consider this content as fund marketing material.