Departing a startup as an executive presents numerous challenging decisions. Among them is the choice between exercising vested Incentive Stock Options (ISOs) within 90 days of departure or opting for an extension of the exercise period, which entails converting your options to non-qualified stock options (NSOs). With a little foresight, you can properly evaluate your choices, rather than be pressured into a non-optimal decision. Delve into the unique features of ISOs and explore the implications of exercising ISOs versus converting them to NSOs below.

ISOs, distinct from NSOs, offer potential benefits for executives provided they adhere to specific guidelines. Some of the key differences include:

- Annual Vesting Limit: You can only vest up to $100,000 of ISOs each year based on the strike price at the time of grant. Any annual amount over $100,000 will automatically be converted to NSOs.

- Tax Implications: Upon exercise, ISOs do not trigger an immediate income tax burden but instead are subject to the alternative minimum tax (AMT). This potentially means that you do not have to pay taxes until quarterly tax estimates are due or in some situations, until the tax filing date associated with the year in which the options were exercised. This can provide some additional breathing room compared to NSOs, which require any income tax burden to be paid in full at the time of exercise.

- AMT Considerations: The federal AMT rate may be lower than your income tax rate. Note that California is one of the few states that has its own AMT, but the good news is it is currently lower than the highest state income tax rate.

- Holding Requirements: To earn the tax benefits, after exercising your ISOs the shares must be held for more than one year from the date of exercise and two years from the time of the grant. Both conditions must be met for the share appreciation to be considered capital gains rather than income. In addition, if the holding requirements are met, capital gains treatment for ISOs is down to the strike price, rather than the fair market value (FMV) at the time of exercise, which is the case for NSOs.

- Conversion Conditions: Any change in the terms of ISOs will result in conversion to NSOs. This includes extending the post-termination exercise period beyond 90 days, changing the option expiration date, or becoming a non-employee (i.e., independent contractor).

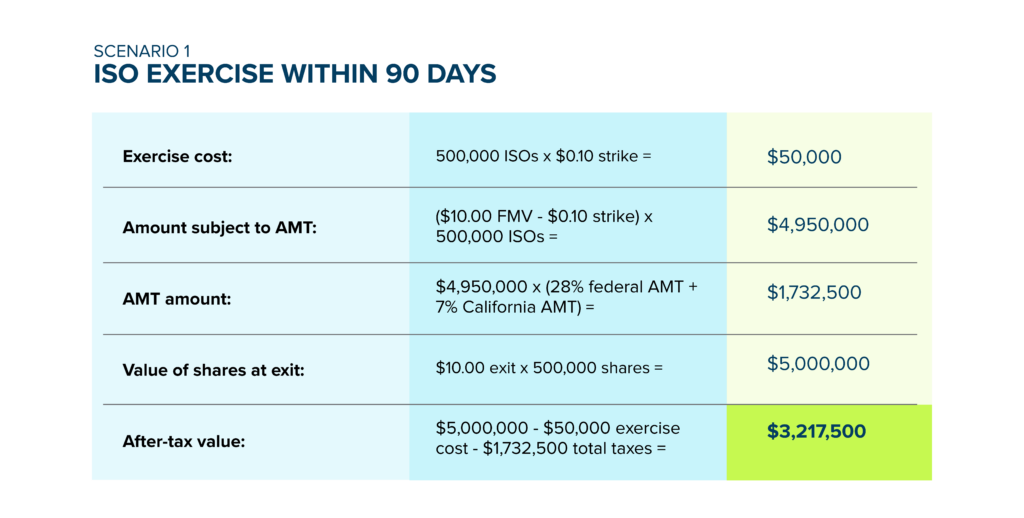

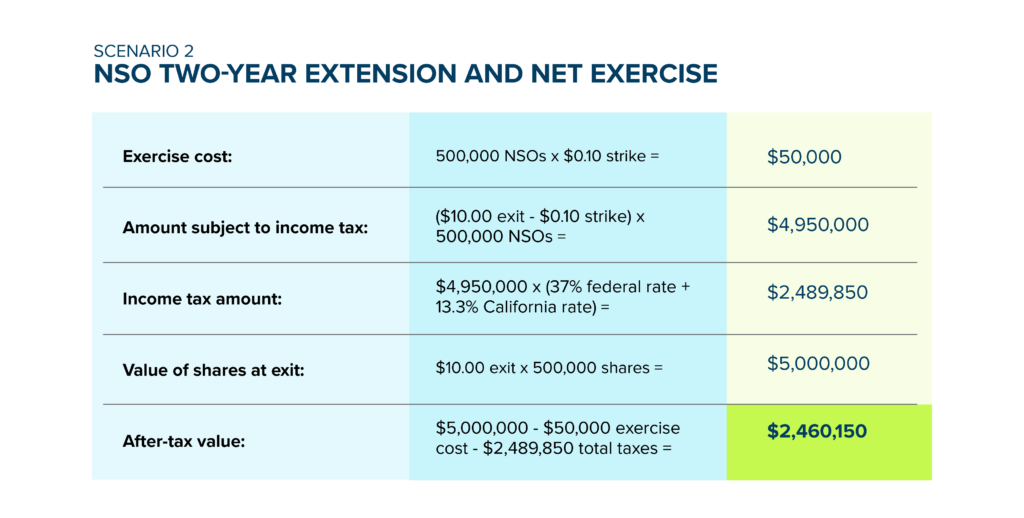

To better understand the potential differences between ISOs and NSOs, let’s analyze a practical scenario faced by many departing executives: Should you exercise ISOs within 90 days of departure, or opt for a 2-year post-termination extension, converting ISOs to NSOs and conduct a net exercise at exit?

Let’s assume you’re a California resident with 500,000 ISOs, a $0.10 strike price, $10.00 FMV for ISO exercise, $10.00/share value at exit two years later, federal income tax rate of 37% and federal AMT rate of 28%.

The comparison reveals a $757,350 advantage in exercising ISOs over converting to NSOs. This is primarily attributed to lower AMT rates and the favorable tax treatment of ISOs down to the strike price if the holding requirement is met, thereby reducing the overall tax liability. Obviously, a lot needs to go right for this to happen, including the company at least holding its valuation steady and a successful exit within the two-year timeframe – events that can be challenging to predict as you prepare to depart. Another aspect to highlight is that with the ISO scenario, you may not have $1,782,500 cash available to cover the exercise costs and AMT, or you don’t have the desire to put that kind of money into a concentrated and illiquid investment for which you could potentially have no information about going forward. So, while exercising ISOs may make the most economic sense, opting to wait and net exercise NSOs might present a lower-risk alternative.

If you find yourself in a similar situation, we recommend first speaking with your tax advisor. If you are considering a capital provider for your option exercise transaction, please reach out to Liquid Stock to learn more about how we might be able to help.

This blog post is intended for general informational and educational purposes only. Liquid Capital Management, LLC (together with its affiliates, “Liquid Stock”) makes no representations as to the accuracy of information in this post, and no representations or guarantees as to specific outcomes from relying on this post. No content in this post is intended or should be construed as tax, investment, legal or accounting advice by Liquid Stock, or as an offer to sell or solicitation of interest to purchase any securities offered by Liquid Stock. Liquid Stock does not provide tax or other financial, legal or regulatory advice to its transaction counterparties. Always consult with your investment, tax, and legal advisors before making important financial decisions. The terms of any Liquid Stock transaction may vary. Outcomes (including financial and tax outcomes) of any transaction will depend on factors including the timing and value of any liquidity event. While reasonable steps have been taken to ensure that the information herein is accurate and up to date, no liability can be accepted for any errors or omissions. All views and information contained herein are as of the date hereof and subject to change. Views and opinions presented are those of the author. Information contained in third-party links has not been independently verified by Liquid Stock and inclusion of such links should not be interpreted as an endorsement or confirmation of the content therein. Prospective investors considering an investment in a Liquid Stock fund should not consider this content as fund marketing material.